Gross Receipts Tax New Mexico 2024. Sales tax in new mexico 2024. The new mexico taxation and revenue department (department) issued new and amended rules reflecting that receipts from certain digital advertising services are subject.

The folders on this page contain everything from returns and instructions to. Currently, the new mexico state gross receipts tax (sales tax) rate is 5% through june 30, 2023, and 4.875% thereafter.

Welcome To The New Mexico Taxation And Revenue Department’s Forms &Amp; Publications Page.

The folders on this page contain everything from returns and instructions to.

If The Measure Is Enacted, New Mexico’s Gross Receipts Tax Would Change To A Sales Tax Effective January 1, 2024.

On march 6, 2024, new mexico’s governor signed.

While The Grt Would Be Reduced To 4.375 Percent By July 1, 2024, That Only Addresses Half The Problem.

Images References :

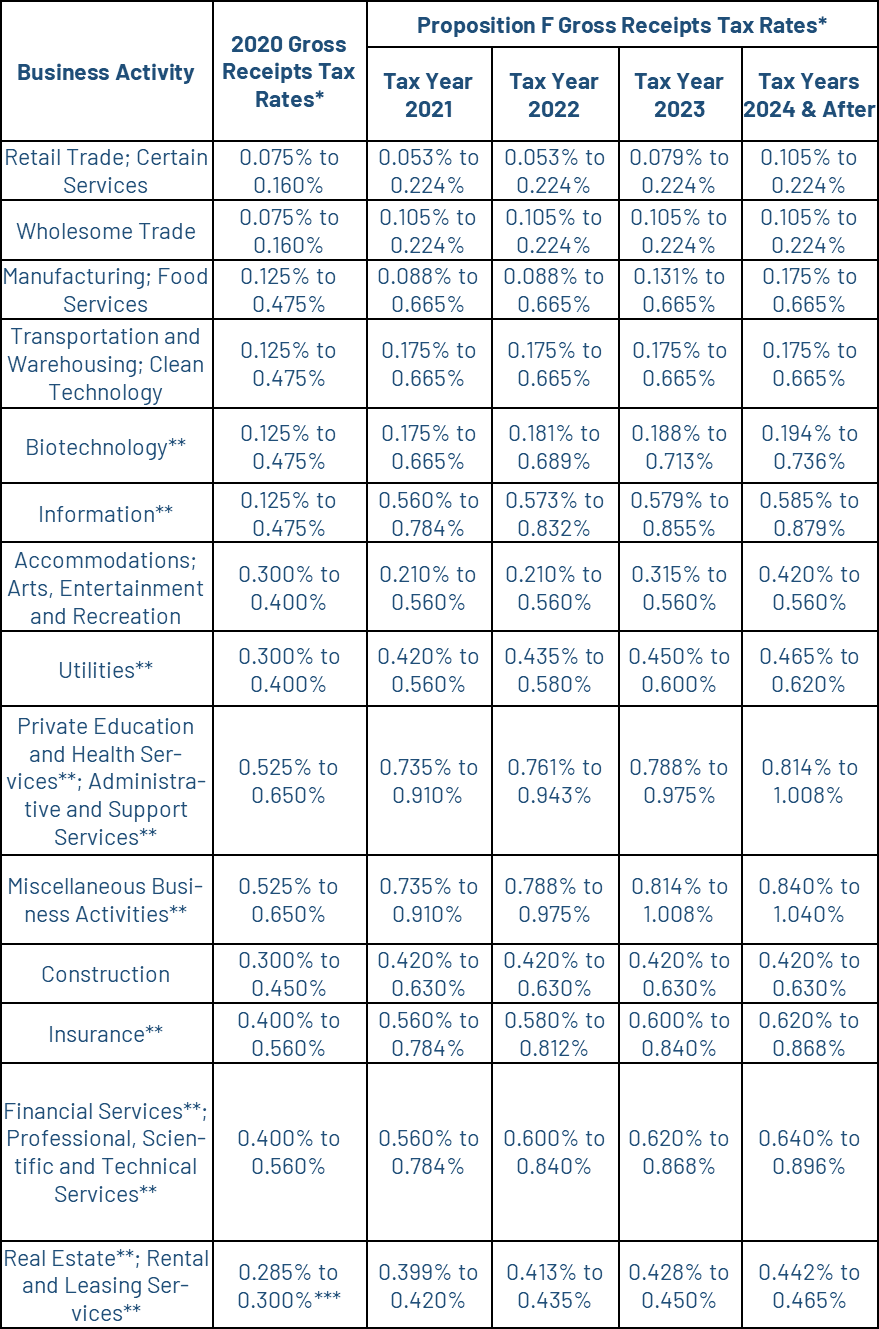

Source: sftreasurer.org

Source: sftreasurer.org

Gross Receipts Tax (GR) Treasurer & Tax Collector, Post july 1, 2022, 5.0%. New mexico tax department publishes gross receipts, compensating tax rate schedule effective jan.

Source: tuluther.blogspot.com

Source: tuluther.blogspot.com

new mexico gross receipts tax table 2021 Tu Luther, (2) physical presence in new mexico (physical nexus). Between now and then, tax officials would have a.

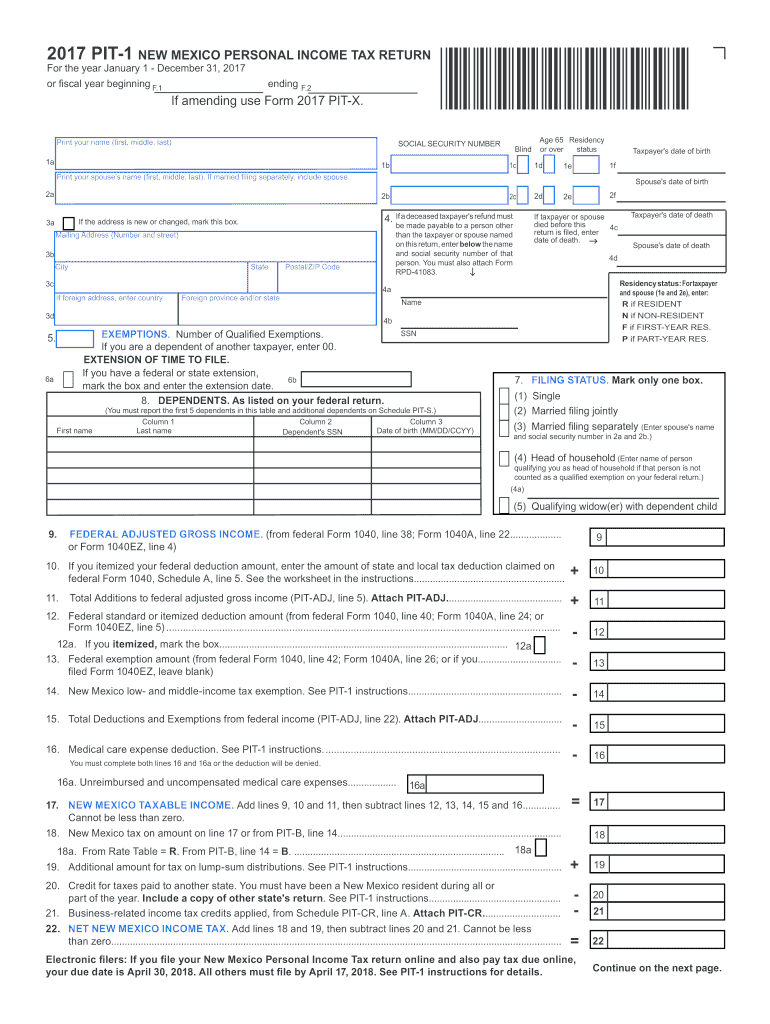

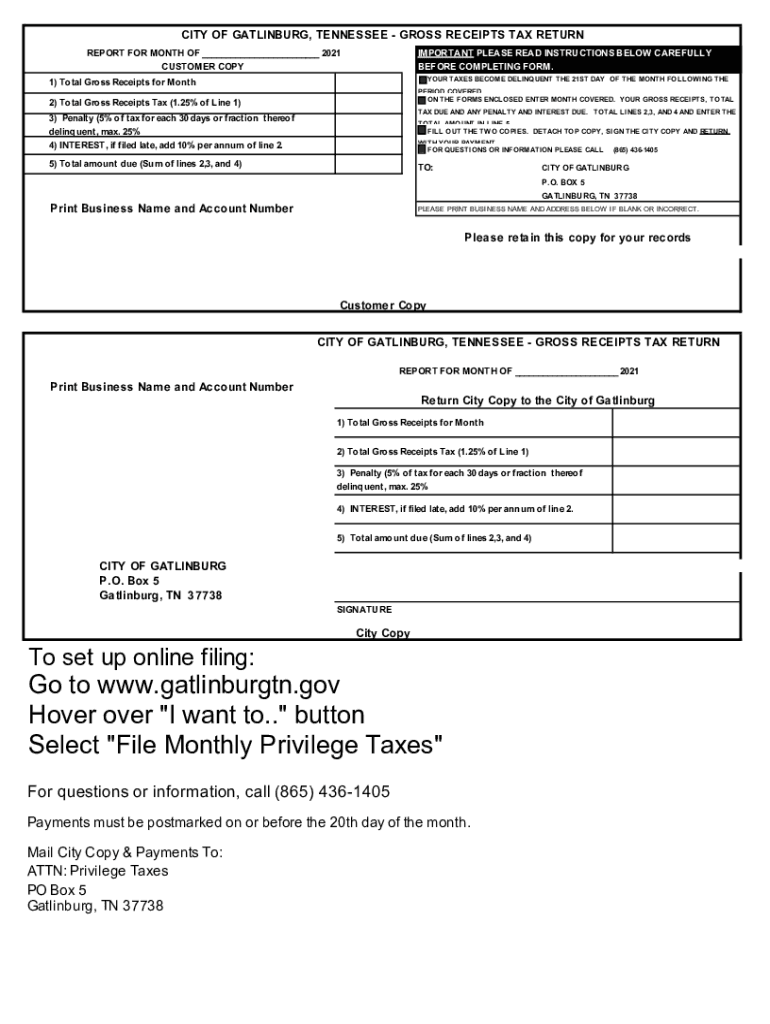

Source: taxpreparationclasses.blogspot.com

Source: taxpreparationclasses.blogspot.com

New Mexico Gross Receipts Tax Return Tax Preparation Classes, The new mexico taxation and revenue. New mexico's gross receipts tax by the numbers:

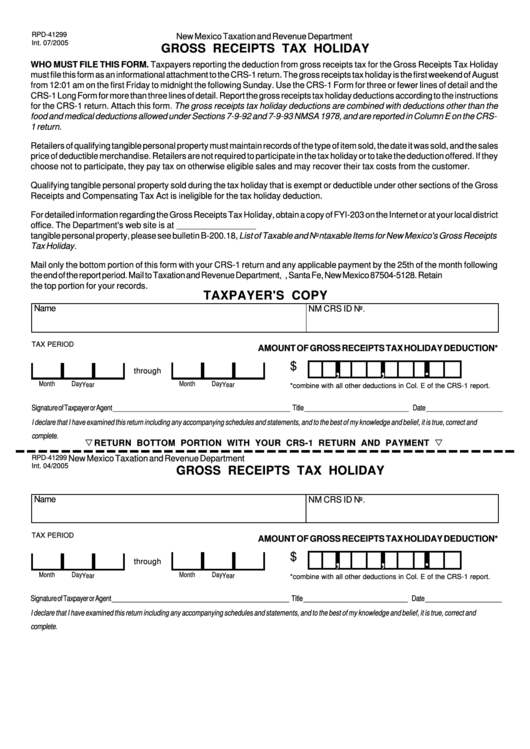

Source: www.formsbank.com

Source: www.formsbank.com

Form Rpd41299 Gross Receipts Tax Holiday New Mexico Taxation And, The rate is on a. This publication includes a description of gross receipts and compensating taxes;

Source: www.signnow.com

Source: www.signnow.com

Gross Receipts 20212024 Form Fill Out and Sign Printable PDF, Post july 1, 2023, 4.875% (if state revenue meets minimum threshold) rate determination (sourcing sales) prior to july 1,. Gross receipts by geographic area and naics code;

Source: duncanjernigan.blogspot.com

Source: duncanjernigan.blogspot.com

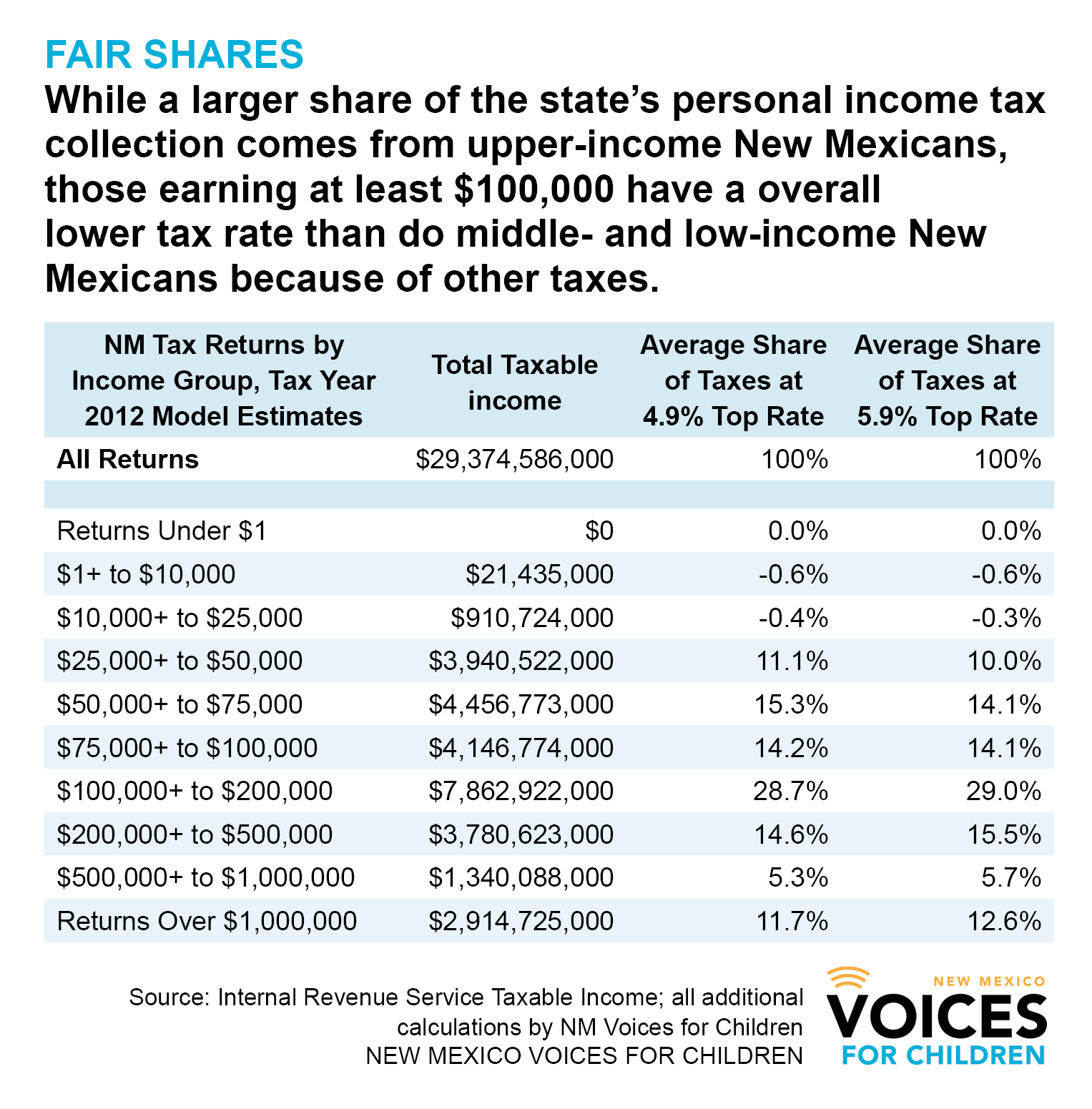

new mexico gross receipts tax changes Duncan Jernigan, New mexico's gross receipts tax by the numbers: The new mexico tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in new mexico, the calculator allows you to calculate.

Source: taxunfiltered.com

Source: taxunfiltered.com

Does Your State Have a Gross Receipts Tax? Tax Unfiltered, (2) physical presence in new mexico (physical nexus). This legislation enacts a flat corporate income tax rate of 5.9%.

Source: taxpreparationclasses.blogspot.com

Source: taxpreparationclasses.blogspot.com

New Mexico Gross Receipts Tax Return Tax Preparation Classes, Pre july 1, 2022, 5.125%. The folders on this page contain everything from returns and instructions to.

:max_bytes(150000):strip_icc()/Gross-receipts_final-f14fcbf7fed046bf855261d9e1e8b846.png) Source: www.investopedia.com

Source: www.investopedia.com

Understanding Gross Receipts With Examples, The new mexico taxation and revenue. The new mexico taxation and revenue department (department) issued new and amended rules reflecting that receipts from certain digital advertising services are subject.

Source: luciendesantis.blogspot.com

Source: luciendesantis.blogspot.com

new mexico gross receipts tax changes Neta Brannon, The new mexico tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in new mexico, the calculator allows you to calculate. Pre july 1, 2022, 5.125%.

Process Description Revision Of New_Mexico_Gross_Receipts_Tax_July_Dec_2023 To Reflect Boundary Changes And Tax Rate Increases And Decreases Effective January 1, 2024.

Post july 1, 2023, 4.875% (if state revenue meets minimum threshold) rate determination (sourcing sales) prior to july 1,.

The Pillsbury State And Local Tax Group Provides A Multistate Perspective On The Complex U.s.

This legislation enacts a flat corporate income tax rate of 5.9%.